people's pension higher rate tax relief

You can claim additional tax relief on your Self Assessment tax return for money you put into a private pension of. On the resulting page find the column.

10 Tax Breaks For People Over 50

Every taxpayer gets basic rate income tax relief applied to their pension contributions at 20 up to the annual pension allowance of.

. End Your Tax Nightmare Now. Ad Owe back tax 10K-200K. See reviews photos directions phone numbers and more for Tax Relief locations in Medford NY.

Basic-rate taxpayers get 20 pension tax relief. Get the Help You Need from Top Tax Relief Companies. Put simply basic rate tax payers need to contribute just 80 to get 100 in their pension.

Ad 5 Best Tax Relief Companies 2022. Pensions Higher Rate Tax Relief. How does higher rate pension tax relief work.

If you are a higher-rate taxpayer you could reclaim an additional 20 tax on your pension contributions for a total of 40 tax relief. Ad See the Top 10 Tax Relief. To find the amount of your HTRC check.

Ad You Dont Have to Face the IRS Alone. Looking for the Best Tax Relief. Expert Reviews Analysis.

Tax Relief for All Pennsylvanians. The tax was first enacted in 2009-10 and adds a two percent assessment charge costing ratepayers nearly 600 million annually. About the Company Higher Rate Tax Pension Relief CuraDebt is a company that provides debt relief from Hollywood Florida.

Higher rate taxpayers only need to pay 60 to get the same 100 retirement pot saving. 21 up to the. Trusted by Over 1000000 Customers.

Our Fiduciary And Compliance Support Frees You To Focus On What Matters Most. This means that 12000 of all the dividend is now taxed at the new basic dividend rate of 875. Ad Do You Owe Over 10K in Back Taxes to the IRS.

Those paying 40 income tax are entitled to 40 pensions tax relief on contributions and 50 taxpayers are entitled to 50 tax relief although this will drop to 45. Ad Do You Owe Over 10K in Back Taxes to the IRS. It was founded in 2000 and is a participant in the American Fair.

Should you consider a lump sum pension withdrawal for your 500K portfolio. Trusted by Over 1000000 Customers. Get Tax Relief from Top Tax Relief Services.

You May Qualify to be Forgiven for Thousands of Dollars in Back Taxes. Expert Reviews Analysis. You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes.

This is one of the biggest benefits of saving. For homeowners outside of New York City. Pennsylvania residents 2011-2012 school tax bills will be reduced by 612 million statewide thanks to slot gamblers at state casinosThe tax break is.

Compare Before You Buy. Owe IRS 10K-110K Back Taxes Check Eligibility. On the next page select your city or town.

However they have a competent support staff that you can contact them not just via email but by phone or by submitting an e-ticket. Select your county below. Ad Your Unique Pension Challenges Call For Customized Solutions.

See if you Qualify for IRS Fresh Start Request Online. In 2013 Senate Republicans fought to phase. 1 up to the amount of any income you have paid 21 tax on.

Tax relief is paid on your pension contributions at the highest rate of income tax you pay. Ad Learn how a lump sum pension withdrawal may give you more income flexibility. Get Tax Relief from Top Tax Relief Services.

Rather than what would have been the higher rate of 3375 leading to a 25. On 23 March which has been dubbed tax day the Treasury will announce new consultations on proposed taxation reforms which could include reforms to pension tax. Get Instant Recommendations Trusted Reviews.

Higher-rate taxpayers can claim 40 pension.

Hogan Lawmakers Announce Agreement On 1 86b In Tax Relief

Pa Property Tax Rent Rebate Apply By 12 31 2022 New 1 Time Bonus Rebate Announced 8 2 2022 Legal Aid Of Southeastern Pennsylvania

Taxes And Your Pension Calpers Perspective

High Income Earners Can Use This Tax Friendly Strategy To Save For Retirement Cnbc Tax Return Higher Income Saving For Retirement

Tax Documents What To Save And How Long To Save It The Motley Fool

How Are Defined Benefit Plans Taxed Impact On Income And Payroll Taxes Saber Pension

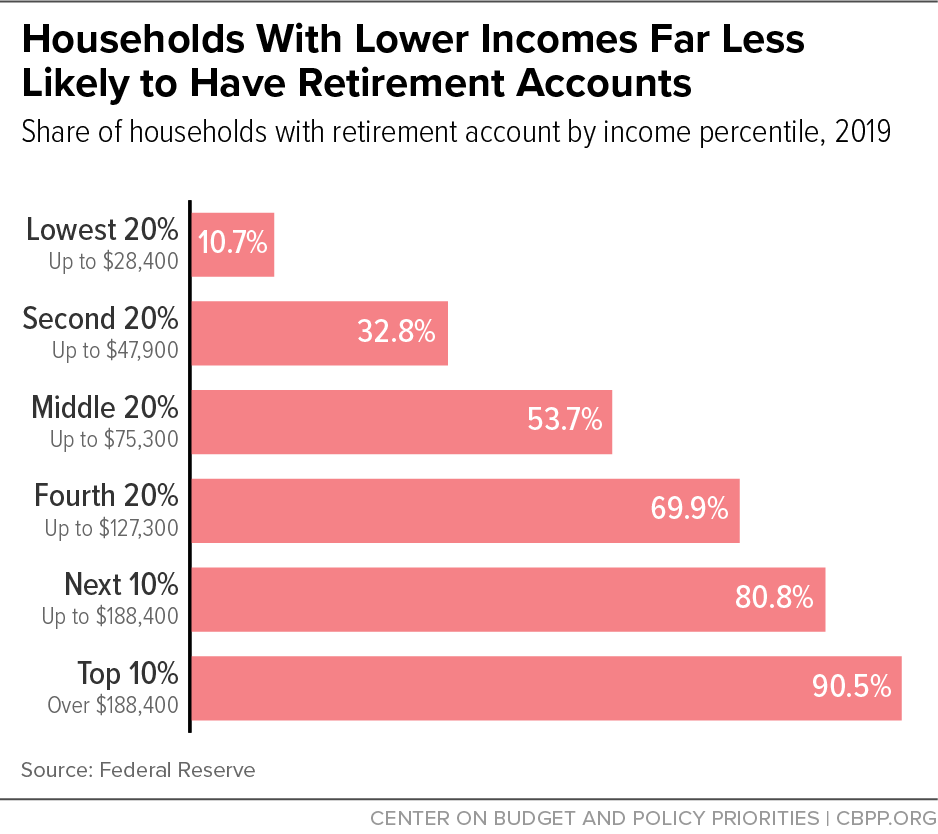

House Bill Would Further Skew Benefits Of Tax Favored Retirement Accounts Center On Budget And Policy Priorities

Universities To Hide Applicants 039 Names In Anti Bias Trial Tuition Tuition Fees Mr Johnson

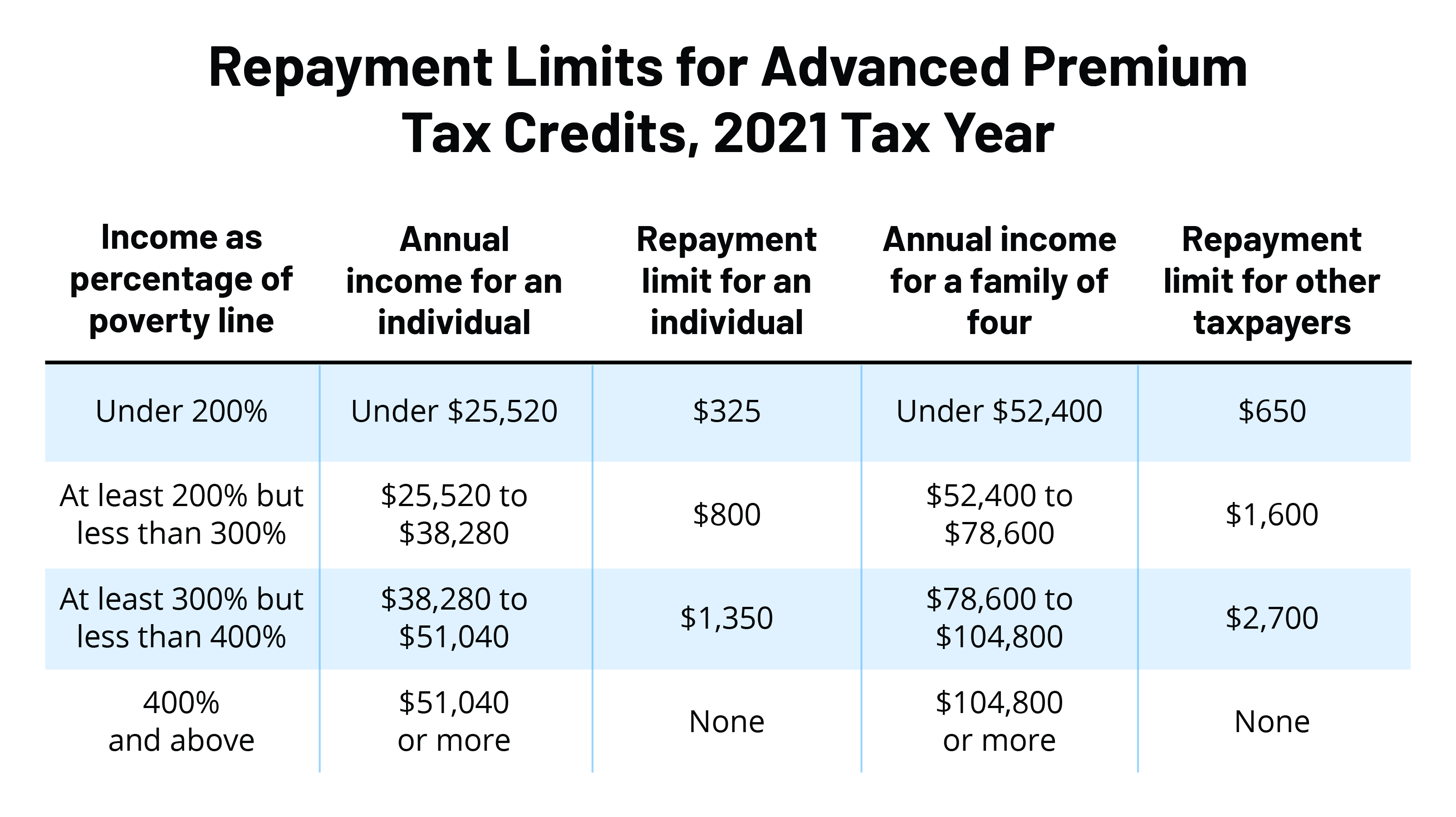

What S The Most I Would Have To Repay The Irs Kff

To Save Their Neighborhood Small Businesses People Are Rebelling Against Delivery Apps The Neighbourhood Estate Planning Attorney Local Businesses

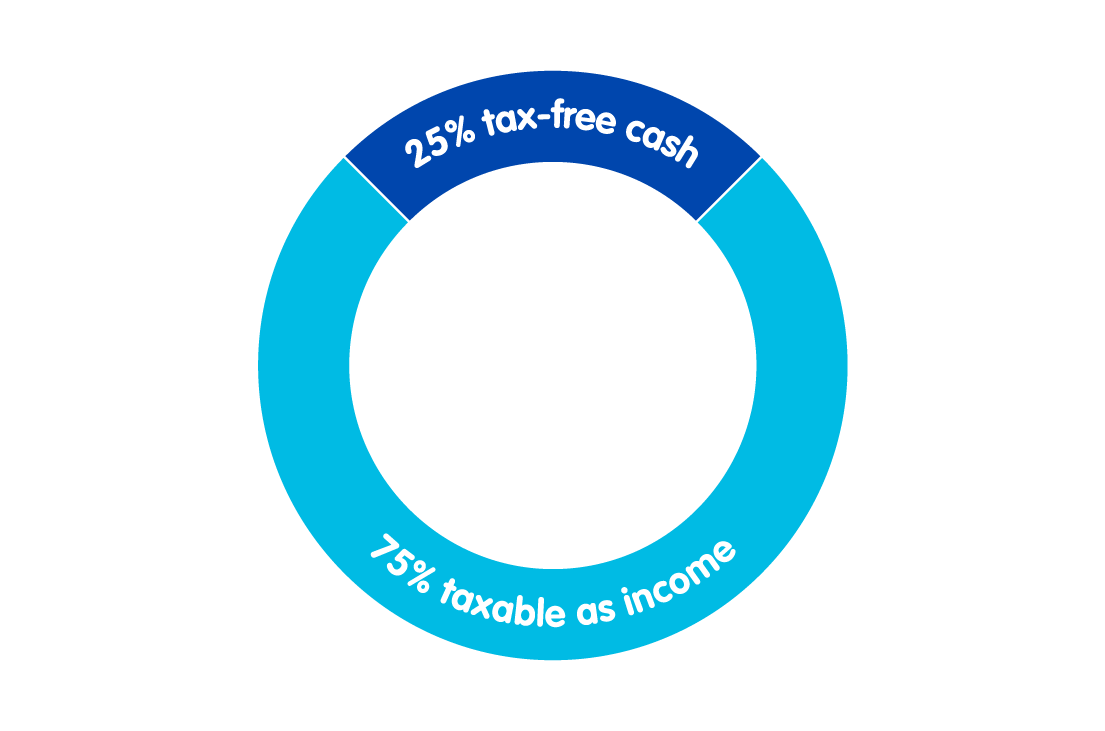

Pension Tax Tax Relief Lifetime Allowance The People S Pension

Rrsp Contributions When S The Best Time To Use Your Deduction In 2022 Deduction Contribution Higher Income

We Ve Rebranded Security Tips Social Security Benefits Social Security

2022 Income Tax Brackets And Standard Deduction

Inflation Is Taking A Big Bite From Retirees Pension Income

Satya Nadella Looks To The Future With Edge Computing Techcrunch Socializacion Estados Financieros Relaciones Sociales

28 99us Lot 100 Pcs Set Different World Notes From 30 50 Countries Free Shipping Gift 100 Real Original Unc Non Currency Coins Aliexpress